retroactive capital gains tax increase

Posted June 10 2021. The maximum rate on long-term capital gains was again.

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

If you have a 500000 portfolio get this must-read guide by Fisher Investments.

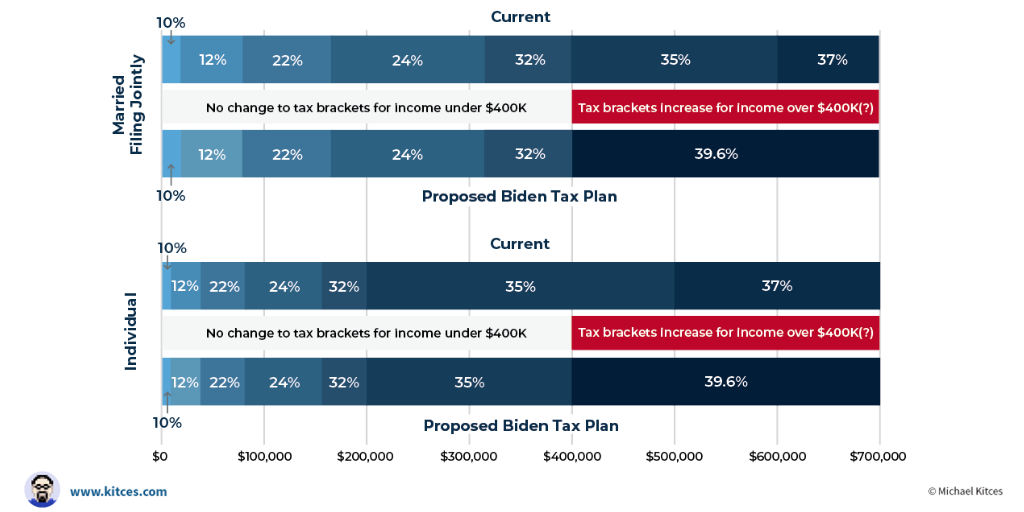

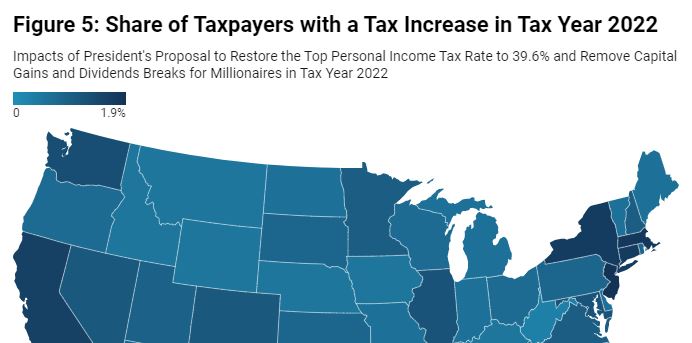

. Talk to Certified Business Tax Experts Online. There have been two major increases in the tax rate applicable to long-term capital gains in the past 50 years. Raising the top marginal tax rate on individual income to 396 percent and applying an 8 percent surtax on MAGI above 25 million would bring the combined top marginal tax rate on individual income to 573 percent up from 429 percent under current law and above the OECD average of 426 percent.

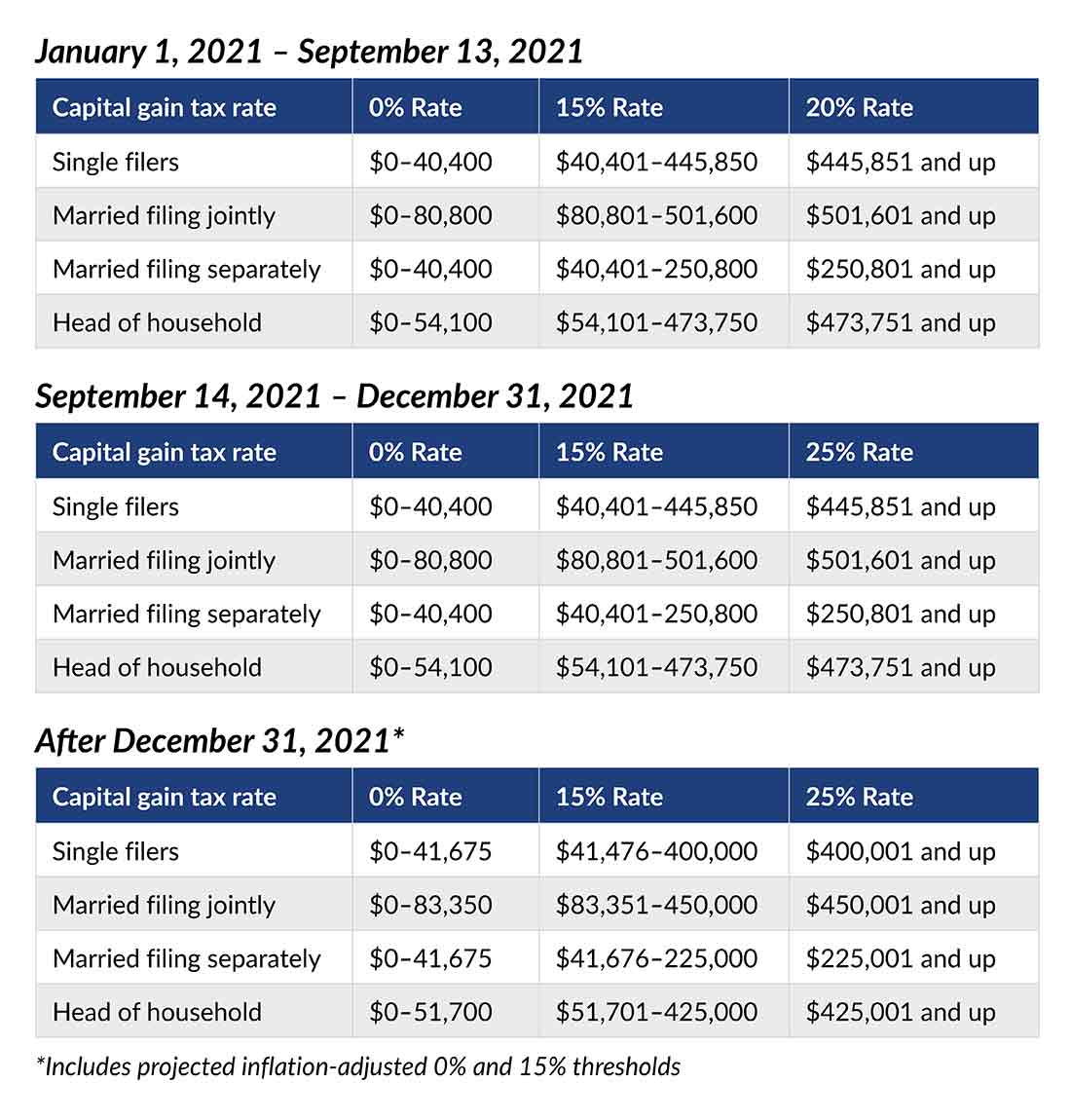

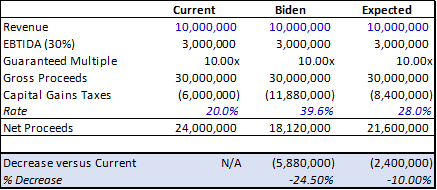

President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396. Of particular interest to investors is the administrations proposal to raise the tax on long-term capital gains from its current maximum rate of 238 percent including the 38 percent net investment income tax to a new rate of 408 percent for certain higher-income taxpayers. There is already some pushback among some congressional Democrats concerning the Presidents capital-gains tax plan.

As was widely anticipated President Bidens budget calls for some significant changes to the capital gains rules including a proposal to increase the top capital gains rate currently 20 to 396 before application of the 38 net investment income tax for income in excess of 1 million. The Presidents proposed 434 capital gain rate is supposed to hit only those earning 1M or more but if you bought a house 30 years ago that is now worth over 1M you could be impacted. The WSJ reports Bidens Budget Said to Assume Capital-Gains Tax Rate Increase Started in April.

This resulted in a 60 increase in the capital gains tax collected in 1986. Top earners may pay up to 434 on long-term. All may not be lost.

If the sale were to occur in 2022 at a 396 long-term capital gain rate that same business owner could net 1208 million. Ad Read this guide to learn ways to avoid running out of money in retirement. The most dramatic tax changes usually occur after a 180-administration change like the one we just experienced.

In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987. This plan was. All the US tax information you need every week.

Bidens Proposed Retroactive Capital Gains Tax Increase. The 1987 capital gains tax collections were slightly below 1985. The proposed budget would increase the taxes on capital gains for Americans earning more than 1 million to 434 which makes the rate the same as these individuals regular income tax rate completely eliminating the tax benefits of capital gains.

In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987. Whereas under the Green Book proposal that. Biden seeks to hike the top rate on capital gains to 434 from 238 for households with income over 1 million.

Lets remember that Congress must still approve any changes in tax rates as well as any retroactive effective dates. But many were taken off guard by the. As was widely anticipated President Bidens budget calls for some significant changes to the capital gains rules including a proposal to increase the top capital gains rate currently 20 to.

Ad 247 Access to Reliable Income Tax Info. Those with adjusted gross income exceeding 1 million if married. Biden unveiled a budget proposal Friday June 4 2021 that called for a 396 top capital gains tax rate to help pay for the American Families Plan.

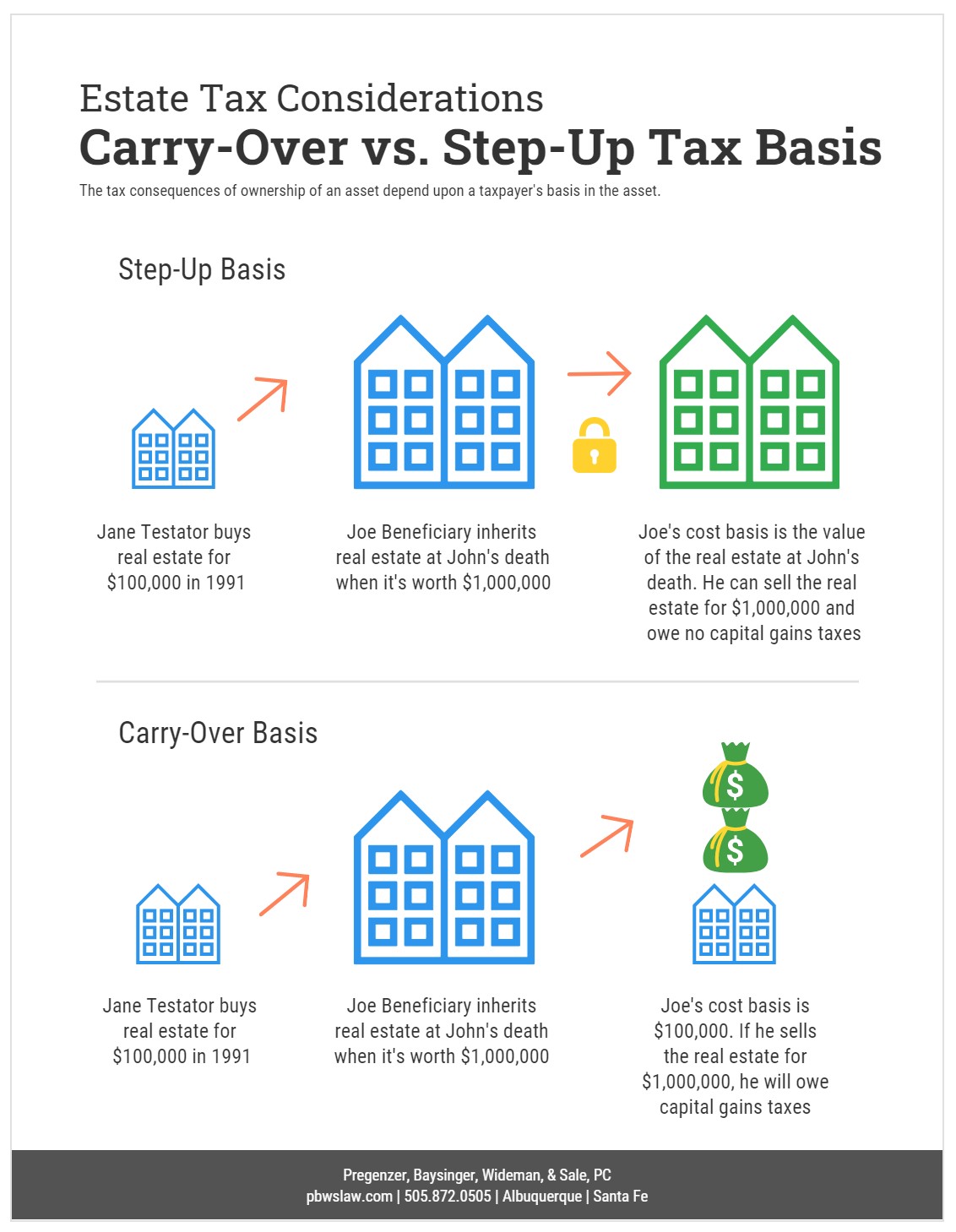

He also wants to make the increase retroactive and force capital gains realization at death as well. Find Reliable Business Tax Info Online in Minutes. As of 2021 the lifetime gift tax exclusion is 117 million per individual and 234 million per married couple.

Chat with a Business Tax Advisor Now. 2 Proposed Biden Retroactive Capital Gains Tax National axpayers Union ondation Could Be Challenged on Constitutional Grounds levying a 10 percent surtax on high earners6 imposing a one-time 25 percent wealth tax7 and imposing an annual 2 percent or 3 percent wealth tax8 One idea in play is a retroactive capital gains tax increase raising the top tax rate currently. Under the retroactive date of announcement proposed in the Green Book that same business owner could net 126 million due to the proposed increase in the capital gains tax rate.

This resulted in a 60 increase in the capital gains tax collected in 1986. Top earners may pay up to 434 on long-term capital gains including the 38 Net Investment Income Tax. So its no surprise that President Biden is calling for significant capital gains increases for income above 1 million hoping to raise the capital gains rate at that level from 20 to 396.

Estate Taxes Under Biden Administration May See Changes

Biden Tax Plan And 2020 Year End Planning Opportunities

A Retroactive Tax Increase Wsj

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

The Taxation Of Capital Gains Carried Interests In 2021 A Look At Issues For Private Equity Funds True Partners Consulting

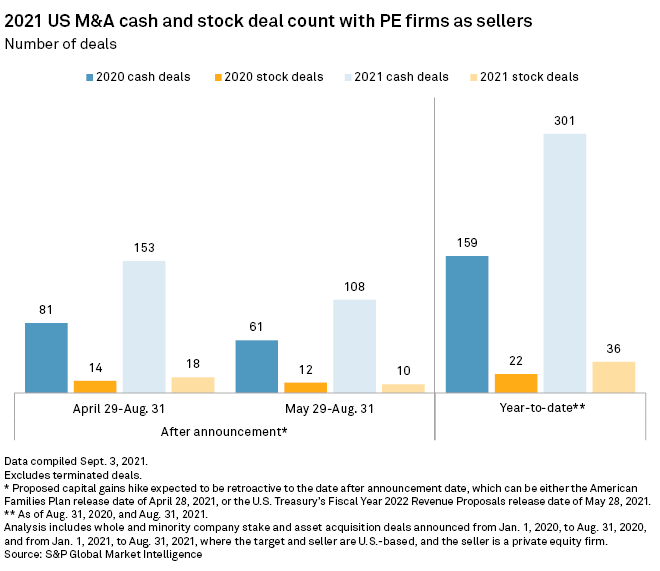

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

What Can The Wealthy Do About Biden S Proposed Tax Increases

Biden S Ex Post Facto Capital Gains Tax Increase Wsj

Income Tax Increases In The President S American Families Plan Itep

Capital Gains Tax Hike Would Imperil Active Mutual Funds Bloomberg

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

Capital Gains Tax Hike Would Imperil Active Mutual Funds Bloomberg